Entities

Search and research entites.

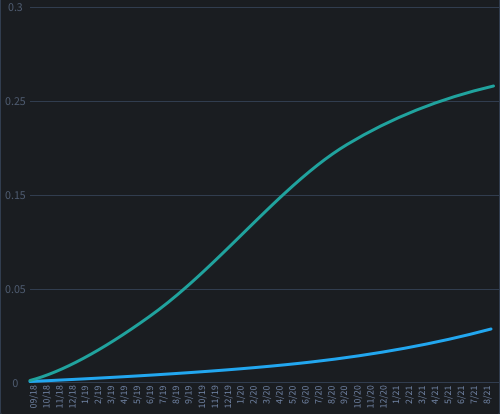

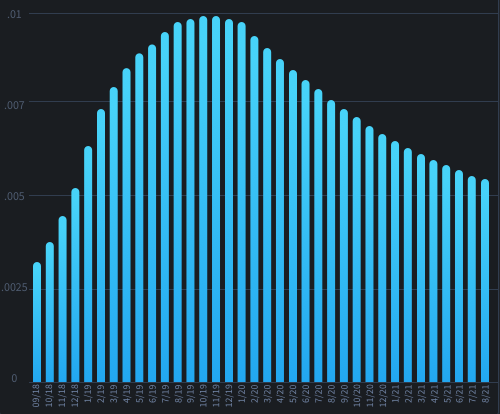

SIGNAL

Annualized

743bps

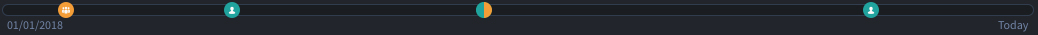

Today

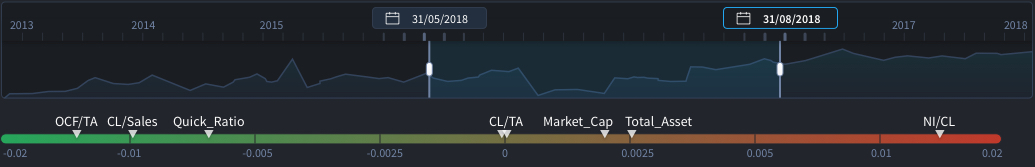

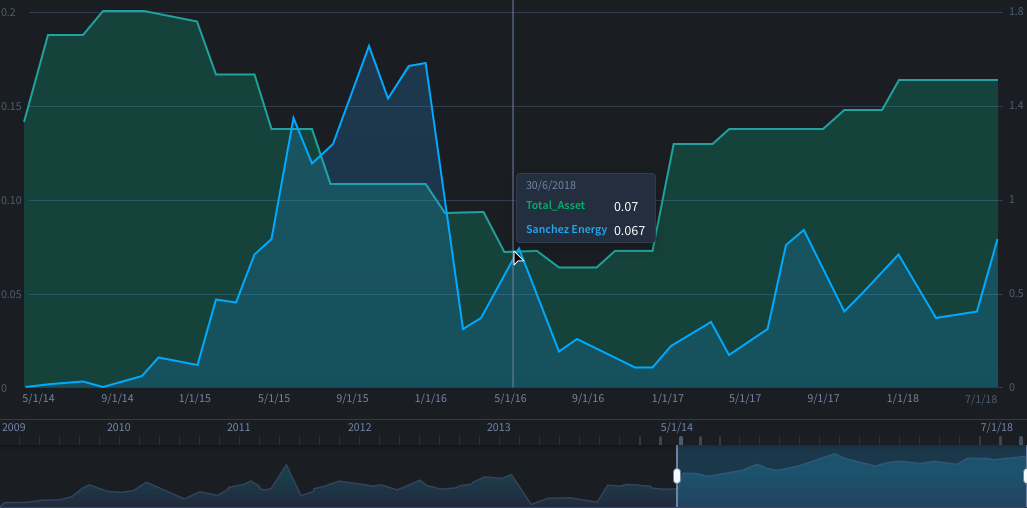

Marginal Driving Force (MDF)

Show the PD change if switching off a risk factor

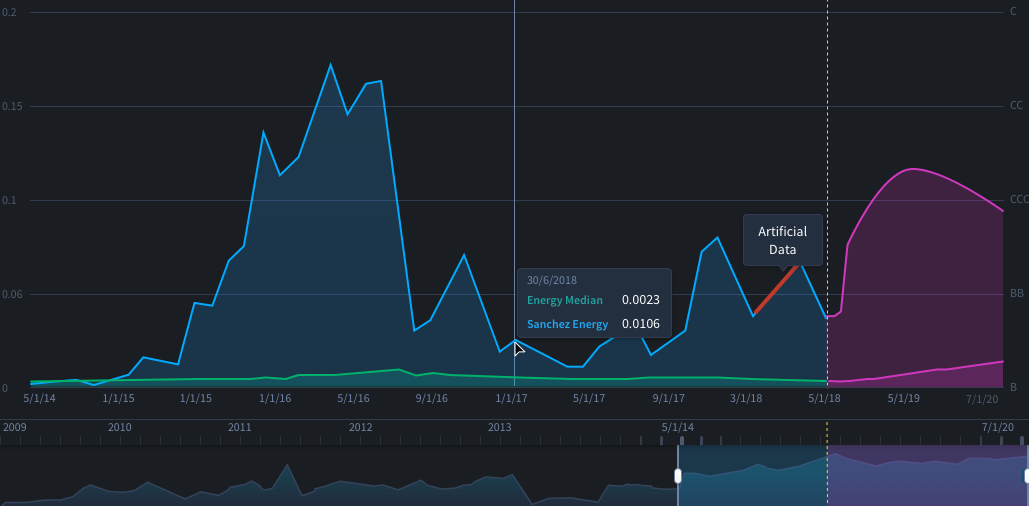

Historical assesment

Shows the marginal and overall PD changes from the earliest to latest in the selected time window